Agriculture

The State Land Board offers agriculture surface leases for grazing, dry land crop production, and irrigated farming.

We own 2.8 million acres of land in Colorado, and approximately 96% of our land is leased for agriculture.

Your agriculture rent payment supports Colorado public schools.

View criteria for consideration when evaluating land rental opportunities for your agriculture operation.

How can we help you?

Rates

Rate adjustments vary for lessees. Adjustments are based on a four-tiered system that accounts for

- Geography

- Ownership of on-site improvements

- and additional factors.

Featured Video: Grazing at Chancellor Ranch

Multiple leases on a property

Trust lands are often leased for a variety of uses under separate and distinct leases, most commonly agriculture and recreation. Each lease describes the specific set of uses allowed under the agreement.

Examples:

- The holder of a grazing lease (lessee) cannot use the property for crop production, and does not hold rights to hunt the property or allow third party hunting access.

- A recreation lessee cannot use the property for livestock grazing.

In order to use any trust land for recreational purposes, you must apply for and obtain a recreation lease from us.

View criteria for consideration when evaluating land rental opportunities for your agriculture operation. Alternatively, view the acreage adjustment process that occurs when trust land leased for agriculture is proposed for renewable energy development.

The Hunting and Fishing Access Program (HFAP)

Colorado Parks and Wildlife (CPW) holds a unique, 973,000-acre lease for the Hunting and Fishing Access Program (HFAP) in order to make trust land publicly accessible to sportsmen.

- CPW is responsible for ensuring that sportsmen comply with the rules and regulations of the lease.

- CPW's field staff must ensure that issues between public users and other existing lessees on the property are addressed and minimized.

- Like any lease, a trust land property enrolled in the HFAP can be removed from the program if there concerns that cannot be resolved.

- View the entire lease contract. (FYI it's 51 pages!) .

We welcome comments from our agriculture lessees regarding the HFAP. Please use the incident report form to inform us about issues that have occurred on your leased land.

Likewise, if you are a member of the public who wishes to make a comment about the PAP, please use our general comment form.

Our Mission

We are guided by our Constitutional mission to steward trust land in order to earn reasonable and consistent money for Colorado public schools. Your agriculture rent payments have helped us earn $1.7 billion for Colorado public schools since 2008.

Our 2026 Strategic Plan outlines four bold goals, including to "protect and enhance the long-term economic value of the trust‚ physical assets: land, water, commercial real estate, and mineral estate."

Stewardship matters to us because our land has to earn money for future generations of schoolchildren. We know that the term stewardship can mean a number of things to different people. Our agency defines stewardship as "an ethic that embodies the responsible planning and management of resources."

Read our strategic plan. Why stewardship matters to us.

Our History

We've been stewarding trust lands since statehood in 1876, and many of your families have held leases with us for generations. Our history dates to America's founding in the 1700s.

We've been stewarding trust lands since statehood in 1876, and many of your families have held leases with us for generations. Our history dates to America's founding in the 1700s.

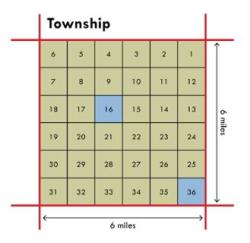

In the 1780s America‚ founders were preparing for westward expansion at the conclusion of the Revolutionary War. Thomas Jefferson developed a system -- today often referred to as the Jeffersonian Grid -- to orderly track and divide land into 36-square-mile townships/ranges/sections.

Each state that joined the union after the war received a certain number of 1-mile sections to be held in a trust and used for public beneficiaries, usually public schools. Colorado received 2 sections per township totalling 4 million acres at statehood in 1876. These are Colorado\'s trust lands.

Q&A

Here's a list of commonly asked questions.

Expiring agriculture and recreation leases as well as vacant parcels available for lease are posted on our website. You may call the district office for more information on the particular parcels you are interested in.

You may access our online MapServer to find who currently leases the property, what the use is, when it expires, etc. If you find a particular lease you are interested in, you can call the district office for that area for more information.

Call or visit the district office for the area you are interested in. Expiring leases are posted on the State Land Board website on a quarterly basis. Vacant parcels available for lease are on the website as well.

Leases can be assigned to other parties for a variety of reasons and are approved or denied at the discretion of the District Manager. Please refer to Guidelines for Agricultural Lease Assignments and the Application for Assignment form. Fees for assignments vary and quotes are available from the district office.

Are you selling your deeded land and trying to assign your state lease? Do not include any reference to a state lease in your deeded land sale advertisements without prior approval from our agency. We've had several situations in which private land was offered for sale “with a state lease” or the seller failed to follow the necessary steps to accomplish a lease assignment and, as a result, was subject to significant financial penalties. You may, however, include the following description of the process for the assignment and transfer of a state lease in your listings: This transaction may also include the assignment of a ### acre agricultural lease with the Colorado State Board of Land Commissioners. Seller is not authorized to assign the lease without the review and approval of the proposed assignment by the State Land Board; approval may be withheld in the State Land Board’s sole discretion. Should a buyer wish to procure the lease, seller agrees to submit the necessary paperwork to the State Land Board to begin the lease assignment review process.

Do not include any reference to a state lease in your deeded land sale advertisements without prior approval from our agency. We've had several situations in which private land was offered for sale “with a state lease” or the seller failed to follow the necessary steps to accomplish a lease assignment and, as a result, was subject to significant financial penalties. You may, however, include the following description of the process for the assignment and transfer of a state lease in your listings: This transaction may also include the assignment of a ### acre agricultural lease with the Colorado State Board of Land Commissioners. Seller is not authorized to assign the lease without the review and approval of the proposed assignment by the State Land Board; approval may be withheld in the State Land Board’s sole discretion. Should a buyer wish to procure the lease, seller agrees to submit the necessary paperwork to the State Land Board to begin the lease assignment review process.

Leases can be assigned to other parties for a variety of reasons and are approved or denied at the discretion of the District Manager. Please refer to Guidelines for Agricultural Lease Assignments and the Application for Assignment form. Fees for assignments vary and quotes are available from the district office.

The Land Board tracks grazing rates through a statewide survey of private leases. This survey is typically conducted every three years. Using this data, the Board may adjust rates to reflect the changes in private rates. The Board adopted a tiered grazing rate structure effective January 1, 2016. See the 2016 Grazing Rate Chart for current rates.

An Animal Unit Month (AUM) is the tenure of one animal unit (1,000 lb cow and her calf) for a period of one month. For example: If you pasture 20 pairs on a pasture for 5 months, you have utilized 100 AUMs. Please refer to the AUM Equivalent Table.

A taxable possessory interest is defined as a private property interest in government-owned property or the right to the occupancy and use of any benefit in government-owned property that has been granted under lease, permit, license, concession, contract or other agreement. The use of the property must be in connection with a business conducted for profit. Agricultural use is considered a business.

The State Land Board has no control over this tax, but rather it is a result of a legislative action that enables the County Assessor's office to charge a tax on leased lands. The only role that the State Land Board plays in this process is to provide an annual report to the Division of Property Taxation listing a record of our state lease data.

The Federal Government endowed the state trust lands to Colorado in 1876. Because these lands are held in trust, they are virtually private. As such, they are closed to the public.

Yes, there are a few policies adopted by the Board for this type of leasing: Grazing Leasing, Cropland Leasing, and Permits. Please note, other Board policies may be applicable as well.

See the State Land Board's Fees &, Payment Considerations schedule for details.

The State Land Board hosts biannual meetings with agriculture industry leaders in an effort to solicit input and share information. Read more.

The State Land Board leases trust land in order to earn money for Colorado public schools. Trust lands are often leased for a variety of uses in order to earn more income for trust beneficiaries.

A trust land parcel can have separate and distinct leases, most commonly agriculture and recreation. Each lease describes the specific set of uses allowed under the agreement.

Examples:

- The holder of a grazing lease (lessee) cannot use the property for crop production, and does not hold rights to hunt the property or allow third party hunting access.

- A recreation lessee cannot use the property for livestock grazing.

In order to use any trust land for recreational purposes, you must apply for and obtain a recreation lease from us.

Colorado Parks and Wildlife (CPW) holds a unique, 970,000-acre lease for the Public Hunting and Fishing Access Program (PHFAP) in order to make trust land publicly accessible to sportsmen. Nearly all trust land enrolled in the PAP is also leased for agriculture.

- CPW is responsible for ensuring that sportsmen comply with the rules and regulations of the lease.

- CPW's field staff must ensure that issues between public users and other existing lessees on the property are addressed and minimized.

- Like any lease, a trust land property enrolled in the PAP can be removed from the program if there concerns that cannot be resolved.

- View the entire lease contract. (FYI it's 51 pages!) .

We welcome comments from our agriculture lessees regarding the Public Access Program (PHFAP). Stay tuned for a comment form.

Likewise, if you are a member of the public who wishes to make a comment about the PHFAP, please use our general comment form.

Colorado Parks and Wildlife (CPW) holds a unique, 770,000-acre lease for the Public Access Program (PAP) in order to make trust land publicly accessible to sportsmen.

- CPW is responsible for ensuring that sportsmen comply with the rules and regulations of the lease.

- CPW's field staff must ensure that issues between public users and other existing lessees on the property are addressed and minimized.

- Like any lease, a trust land property enrolled in the PAP can be removed from the program if there concerns that cannot be resolved.

- View the entire lease contract. (FYI it's 51 pages!) .

We welcome comments from our agriculture lessees regarding the Public Access Program (PAP). Please use the incident report form to inform us about issues that have occurred on your leased land.

Likewise, if you are a member of the public who wishes to make a comment about the PAP, please use our general comment form.

View criteria for consideration when evaluating land rental opportunities for your agriculture operation.

Still not finding the answer to your question?

Forms and Instructions

Assignments

Collateral Interest

Competitive bids

Customer contact information

Homesites

Improvements

Land and Water

Lease Applications and Materials

- Agriculture Leasing Application Packet (New Lease)

- Agriculture Leasing Application Packet (Renewal Lease)

- Agriculture Leasing Renewal Instructions

Leasehold

- Leasehold Authorization Guidelines

- Leasehold Rider for Addition/Deletion of Family Members/Entities

- Waiver of Agriculture Lease Renewal Rights

Sub-leasing

Weeds